The Payment Times Reporting Scheme is here.

The Payment Times Reporting Scheme is an Act of the Australian Parliament; it has been approved and it is in progress for 2021.

The PTRS had been a volunteer reporting scheme for about 3 years to encourage large businesses to speed up payments to small businesses. However, with no carrot or stick for big business, few businesses reported their payment times.

The Department of Industry realised they would need to make reporting compulsory and with this understanding the Payment Times Reporting Act was passed and is in place for 2021.

The main objective of the payment times reporting scheme is to encourage Large Companies to pay Small Enterprises faster and inject cash into the Australian Economy.

If we look at the stats, small businesses were being paid on average 23 days late.

The whole idea of the Payment Times Reporting Act is to increase transparency, to create an incentive to improve payment times and to see how Australian organisations are interacting.

Amendments have been tabled on the Act

If the median of all payments is greater than 30 days, the median number of businesses who are required to report will be considered recalcitrant reporting entities, these companies will be required to pay within 30 days and there will likely be civil penalties, suggested to start at 0.6% of annual revenue.

Once the Government has 3 years of data on payment times, the Department of Industry will decide to bring in civil penalties, or not, for late payments. Our bet is that they will need to bring in penalties for compliance.

Who has to report?

Companies with revenue of over $100 million, including Overseas companies trading in Australia. Also, if you are a controlling company with subsidiaries i.e.

Who is excluded?

The PTRS excludes charities, non-profits and government agencies.

The New Accountability

Payment times will be published online and that’s the major risk and challenge of the PTRS for large companies.

For 2021, it will be a name and shame game. Your payment times will be published and accessible by the public and the media.

In the second year, 2022, the full implementation will come about. The regulator will do audits and encourage compliance more actively.

The Process and PTRS Reporting Requirements

- Company Name, ABN, Business Activity, Declaration by Officer

- Shortest and Longest Payment Time, Any changes over reporting period

- Timings

- And any financial arrangements

What you need to consider for a complete and accurate reporting list:

- Only Active / Valid ABNs

- No Duplicate Vendors

- ABN

- Name

- Bank Account

- Address

- Other info

- Missing key data

- ABNs

- Payment Terms

- Payment Types

What can you do?

- Ensure your vendor master file is up to date

- Resolve issues immediately

- Continuously Review VM (automate)

- Upload to SBI Toll, list of large vendors, Calculate Small Enterprises

- Flag any changes, a small business does not have to flag or declare itself as a small business.

What does the CCM PTRS Solution look like?

- A continuous upload to SBI to check who is a Small Enterprise

- A continuously clean Vendor Master File is used to upload into SBI Portal to avoid any false positives

- Flagging of any changes (new Small Enterprises)

- A continuously updated Vendor Master File

- Everything becomes automated – where possible

- Positive impact on the next business processes

Using the AP Transactions from ERP:

- Know which SEs are paid late / early

- Ensure outliers are remediated(workflow)

- What was the reason and action (recorded)

- Ensure you have standard terms identified

- Identify which SEs are paid in/out of std term

- Corrective action on terms

CCM Solution

- Don’t missing anything

- Follow up errors when identified

- Have a record of all changes, errors and updates.

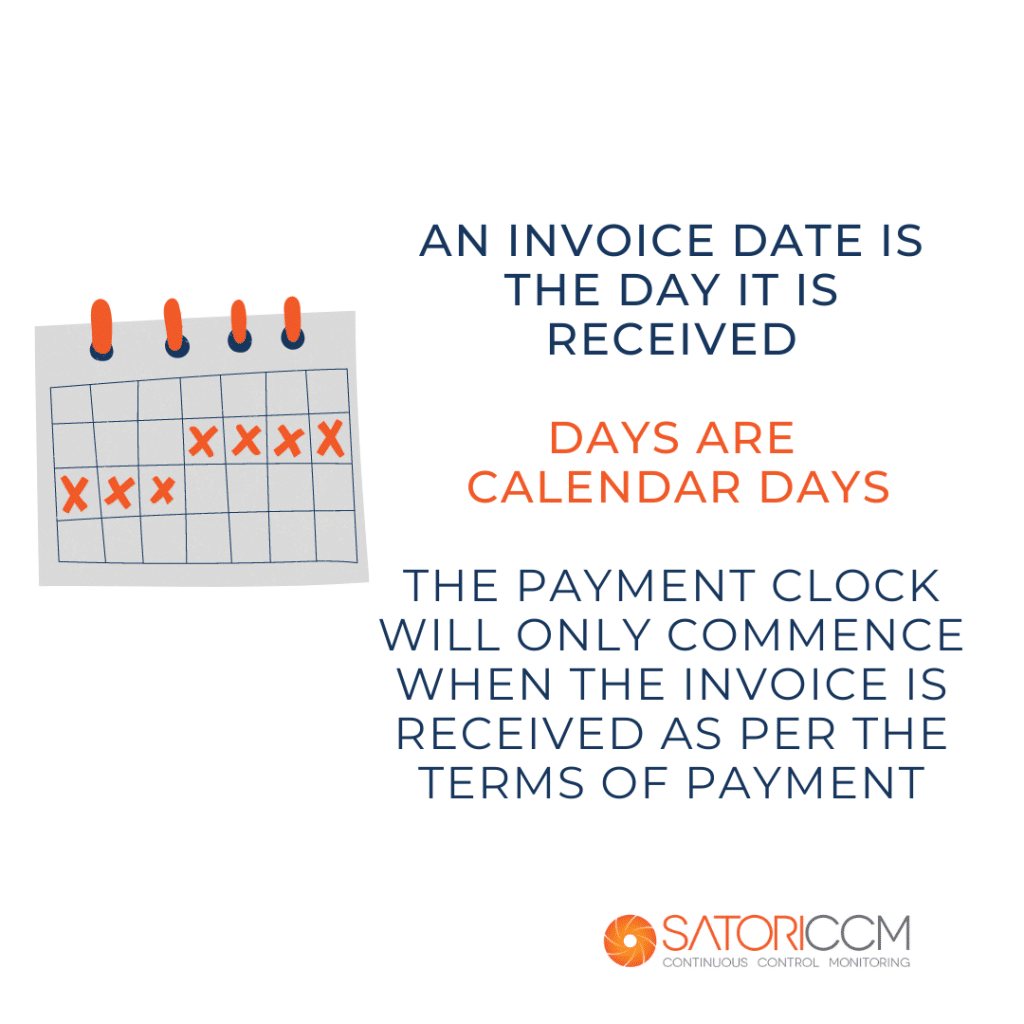

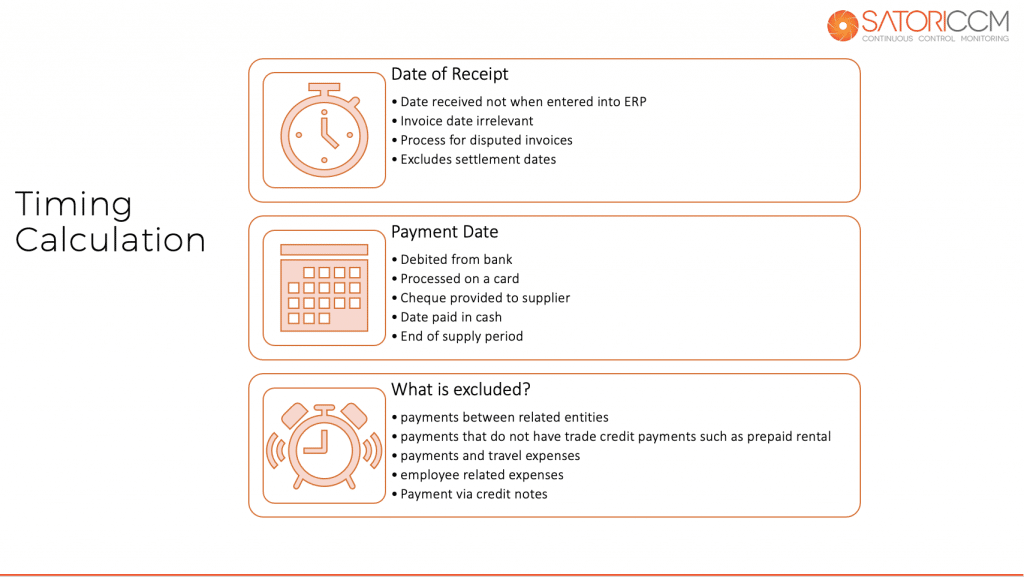

How will you manage Invoice Issue days for the PTRS?

- The invoice issue day is when an invoice is received by the reporting entity (date of receipt).

- An invoice is ‘received’ and the payment clock ‘commences’ when it is received by the entity in accordance with the invoicing requirements of the relevant contract (either written or oral).

- This could include contractual arrangements in order for payments to be made. For example,

- having to provide the invoice to a particular email address

- requiring that the invoice includes a purchase order number and ABN.

- The contractual arrangements may also deal with matters such as the treatment of incorrect invoices.

Incorrectly received invoice example

- An employee of Entity X receives an invoice from Small Business Y.

- The agreement states invoices will only be accepted if they are submitted to Entity X’s shared inbox.

- Until that invoice is received in Entity X’s shared inbox, the invoice is not deemed to have been received.

- The payment clock for this invoice has yet to commence.

Date of receipt is not:

- when the invoice is entered into the entity’s accounting or information systems

- when the invoice is authorised

- If the receipt date is unknown or cannot be established (i.e. the entity receives paper invoices), then the date of the invoice can be used as the date of receipt.

- This option is intended to be phased out over time.

- Businesses will then need to calculate their payment time from the date the invoices are received.

Small business invoice Arrangements

Details of any arrangements for accepting invoices:

- accepting invoices only on certain days of the month, or at the end of the month

- requiring a total amount to be spent before an invoice will be paid

- imposing arrangements for progress payments

- making payments dependent on the entity selling the goods or services provided by the small business

- process for disputed invoices

How are you going to handle a disputed invoice under the PTRS Rules?

Is it fraudulent for work not yet completed? This could result in you reporting a payment late or paying quickly and then having to try to get the money back.

Examples for negotiated terms

Example 1

- The standard payment term is 30 days

- offered a dynamic discount of 2% to receive payment in 10 days

- the RE must use 30 days when calculating its payment times for reporting purposes

Example 2

- The standard payment term is 30 days

- have negotiated a settlement discount

- a 2% discount for the invoice to be paid within 5 days

- RE must use 30 days when calculating its payment times for reporting purposes

- This will ensure that payment times are reported transparently. It will not be obscured by supply chain finance arrangements.

The Payment Times Reporting Act is about transparency in the way companies work together, to get a view of the economy. The Government is working out if late payments are a problem for the economy or not.

In Review

How can Continuous Control Monitoring Help with the PTRS?

- Automate the process where possible

- Understand the root cause of any delays

- To be compliant on every payment every day

- Ensure your controls, policies and procedures are still operating as designed

- Avoid getting a surprise in 6 months’ time

- Not leaving payments to when it’s too late to fix up

- Not paying on a blanket policy (7 days)

- Managing this as Business As Usual process

- Evolving as the business changes and evolves

- Its more than just about doing a report every 6 monthsSatori will be providing a solution to our existing CCM customers and have developed new tests to ensure compliance, the cost of CCM is affordable and less than companies hiring someone to do the PTRS report internally.

Into the Future

If you are compliant for 3 years, can you stop reporting?

We doubt it. In 3 years’ time it’s more likely that Department of Industry will mandate the reporting, not revert to making it voluntary.

Learn More About Continuous Control Monitoring

*https://www.industry.gov.au/data-and-publications/payment-times-reporting-scheme-guidance-for-reporting-entities/reporting-requirements