Significantly reduce your exposure to fraud, financial crime, and regulatory non-compliance through automated, AI-driven transaction monitoring.

Automated Anti Money Laundering Monitoring

An end-to-end solution to an increasingly complex threat

Financial Crime is said to amount to US$1.4 trillion – US$3.5 trillion annually. No organisation is safe with criminals becoming more aggressive and sophisticated. Your business is facing greater financial and reputational risk than ever before, especially when carrying out transactions with third parties. Tightening regulations and growing demands by customers for integrity are placing greater demands on your organisation to monitor and report suspicious activities.

Your round-the-clock defense team

Create greater efficiency through artificial intelligence and automation to improve your organisations regulatory Anti Money Laundering compliance obligations.

Have the ability to provide instant evidence of exception investigation outcomes to audit or the regulator.

Detect suspicious activities in real-time and greatly reduce your organisations fraud risk.

Automatically generate the required regulatory reporting to reduce administrative overhead.

The Satori Solution

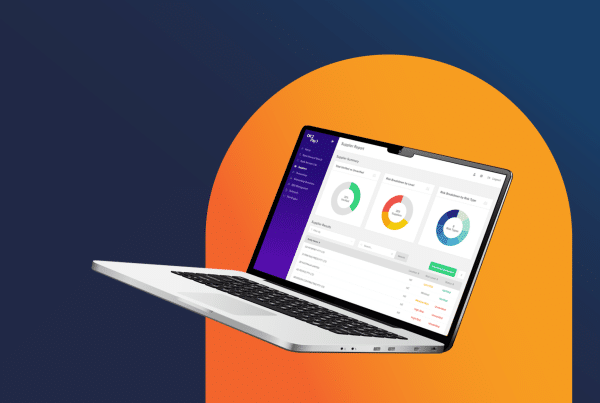

Satori is a Software as a Service that offers automated, AI-driven, continuous transaction monitoring.

The Solution’s workflow manages exception output to ensure follow-up in a timely manner by the team or the person of responsibility. Each exception is investigated and closed out with a defined issue, action, and root cause.

Satori’s Dashboards provide management with real-time visibility on what issues are occurring and their root causes, enabling opportunities for process improvements.

Satori for every Anti Money Laundering scenario

Automated Anti Money Laundering

- Cash deposits over $10,000

- Flipping – individuals turning over cash in a short period of time

- Potentially structured cash deposits over $10,000

- Transactions with high-risk customers

- Suspicious transactions

”Millions saved from one test of procurement data that detected a years-long fraud, fuelled by a gambling debt. The case went to Court and there was a conviction.

Large ASX Listed BusinessChief Financial Officer

Get more Information

Satori adds Australia’s only bank-verified account verification solution to their services with the acquisition of OK2Pay

TRUSTED BY OVER 200+ ORGANISATIONS

Contact Us

Complete the form below and a specialist from our team will be in touch

"*" indicates required fields