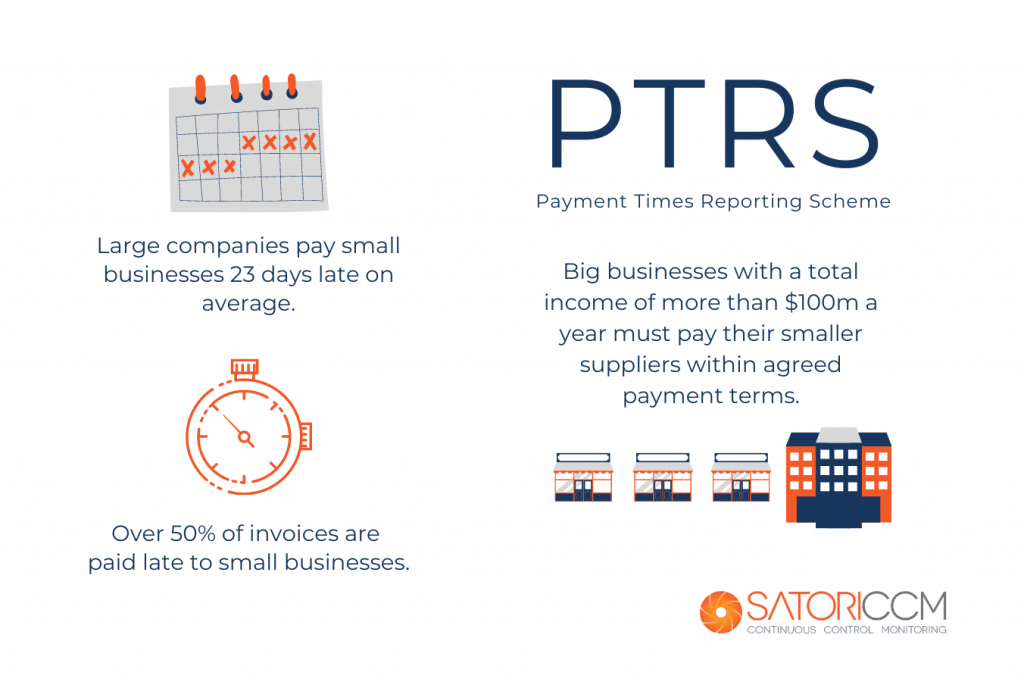

To support small business, big businesses must pay on time, or earlier!

But there have been no fines handed out to date.

Loud rumblings in the media suggest this might be about to change…

Learn More about managing the PTRS Here

“Australia’s payment times watchdog says it will intensify its focus on big businesses in 2023, after the release of “concerning” data showing the average payment time to small businesses barely budged in 2022.”

“Large businesses have stewardship over important supply chains and it is critical that they pay their suppliers on time and even ahead of time, for the good of the businesses involved and ultimately the whole economy. This will say more about those large businesses, their corporate values and the integrity of their brand than anything else they’ve likely done as an organisation.” Previous PM Scott Morrison said at the time of the PTRS launch.

So how will big business be able to manage which of their vendors are considered small business?*

From the 1st January 2021, the PTRS came into force with the first reporting period to be July 2021. The PTRS aim is to improve payment times for Australian small and medium (“SME”) businesses. Large businesses and large government enterprises will need to report their SME payment terms and times processed.

In the first year there were no penalties or enforcement of this act, non-complying companies will still be listed on the registrar’s website. From 2022, this act will be enforced with significant penalties and media publication of non–conforming entities.

What is the Payment Times Reporting Act 2020?

In brief, this is an Act of the Australia Parliament, that is designed to encourage companies with a turnover of $100million per annual to pay small and medium size companies quicker (within the payment terms specified). The Australian Government will publish the reports twice a year on an online public register.

The Payment Times Reporting Act will:

- increase transparency around large business’ payment performance

- help small businesses decide who to do business with

- create incentives for improved payment times and practices

- help the general public make decisions about the large businesses they buy from

As Payment Times Reports will be made public, there will be significant incentive for large businesses to make sure they improve their payment times performance, meaning small business suppliers will get paid quicker.

Click here to view the PTRS ACT

Why is the PTRS needed?

The impact of late payment times on SME businesses was highlighted in findings from two inquiries into Payment Times and Practices released in 2017 and 2019 prepared by the Australian Small Business and Family Enterprise Ombudsman (ASBFEO).

These reports showed that longer payment times constrain small business cash flow and this harms their ability to hire, invest and grow.

How does the PTRS work?

Companies that qualify (>$100million in annual revenue) need to upload a list of their vendors to the PTRS Small Business Identification System (SBI) which helps to identify which ABNs qualify for the scheme and which ABNs can be excluded. This list needs to be checked every 6 months, as company statuses can change.

Every 6 months, a report (the exact format is provided by the PTRS and specified by the Act) is to be uploaded into the PTRS system and this report is then published.

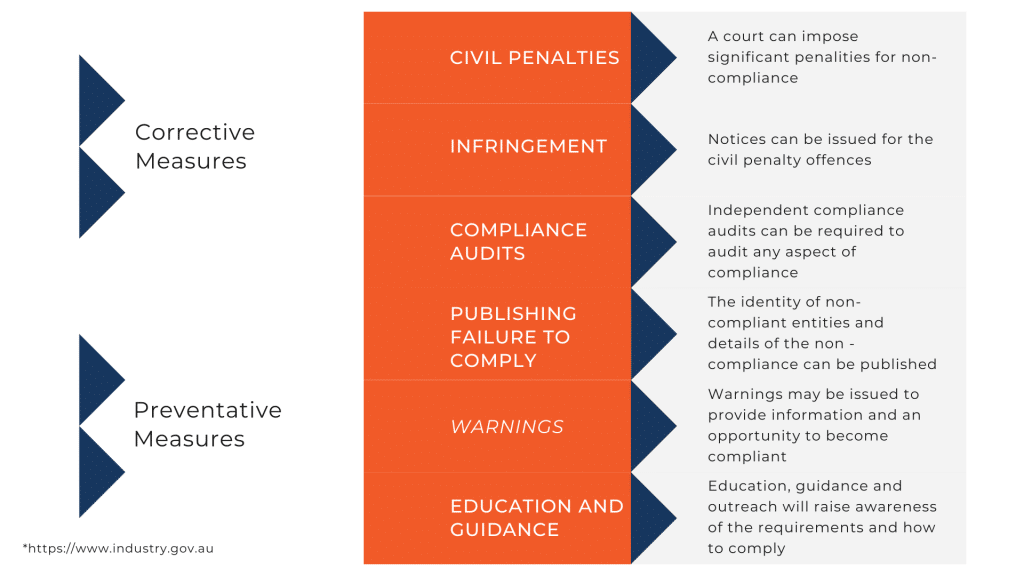

What are the Penalties and when does this come info effect?

The Act includes an initial 12 month transition period, ending on 31 December 2021, during which compliance and penalties will not be enforced by the Regulator.

- During the transition period the focus is on awareness, education and guidance to encourage and assist with compliance.

- The Regulator will use the 12 month transition period to build a culture of compliance and develop its intelligence and investigative capabilities.

The focus by the regulator will be on preventative measure, not punitive.

What information needs to be in the PTRS report?

The reports will include:

- the entity’s name and ABN

- a description of the entity’s main business activity

- the reporting period

- a statement on the standard payment periods for the entity

- the details of any change to the standard payment periods

- the proportion of small business invoices paid during the reporting

- the proportion of all procurement from small business suppliers

- the details of the principal governing body of the entity

- a statement of whether the entity is a member of a controlling corporation’s group

- a declaration by the responsible member that the report will be provided to the principal governing body.

- the name of the responsible member who signed the report and the date it was signed

- the name and contact details of the individual giving the report to the Regulator

- if a notifiable event has occurred since the last payment times report, the details of the notifiable event

- any other information or documents prescribed by the Rules

How can Satori help you comply with the scheme?

The requirements for PTRS can be time consuming and resource intensive in order to comply. An entity cannot simply wait until the reporting period and prepare the report, as it needs to change practices and processes to ensure it is paying the right vendors on the right terms. Simply paying all vendors quickly (eg: 7 days) can result in cash flow and other issues. Incorrect or invalid ABNs can make identifying SME vendors problematic.

- Impact on cashflow if paying too quick

- No early payment rebates applied

- Possibly paying before the invoice is due (cash flow impact)

- Possible errors through duplicate payments or non-adherence to internal processes and controls

- Susceptibility to possible fraud and other errors due to the quick turnaround in payment

- Increased workload on the payment team

- Payment processes without the due diligence applied

Satori provides a solution, SatoriCCM, that helps automate the PTRS monitoring and reporting as well as assists to identify errors prior to reporting, in a time effective and efficient manner and ensure that any new issues are identified as they occur. SatoriCCM helps ensure that the controls, checks and balances, are in place to help alleviate the pressure on the team, so in effect not needing additional new resources, or workloads, whilst gaining benefits.

SatoriCCM performs a range of checks and tests on vendor master data as well as transaction data to achieve these benefits. SatoriCCM provides a workflow mechanism thats ensures that any issues identified, are followed up and actioned.

Vendor Master File Tests

Validate Vendor ABNs

Ensure ABNs are correct, valid, active, registered for GST or not (checked daily). This ensure a clean and accurate list of vendors to be assessed.

Eliminate Duplicate Vendors

Ensure there are no duplicate Vendors or vendors that should not be reported on.

Identify Payment days

Identify that there are payment times for each vendor to be used to check against timing of actual payments and if any rebates should be applied. SatoriCCM will help to ensure it is highlighted when these terms are not adhered to.

Identify Eligible Vendors via SBI Portal

Automate the process to check which vendors qualify and if any changes to the previous reporting period.

AP Transactions

Accessing and analysing all the Accounts Payable transactions to automate and check the following:

Payment Times

From Invoice receipt date to Payment date – is this within the correct period.

Late Payment

Ensuring there is an emphasis and follow up on late payment to understand why this is happening and how this can be resolved for the future.

Duplicate Payments

Ensuring there are no duplicate payments due to the reduced times, possible controls and oversight.

PTRS Report

Producing the PTRS report every 6 months so that it can be loaded into the portal. This is automatically created, with any relevant comments.

The Satori Solution

Our solution (hosted on Microsoft Azure in Australia) provides all the techniques and services required to analyse and monitor Master file and Transaction data, as well as provide oversight into any remediation that is required. SatoriCCM can be extended beyond PTRS reporting, to ensure that all vendors and transactions comply, but also to ensure that all the internal controls are well designed and are working as effectively, efficiently as possible – continuously.

Learn More about managing the PTRS Here