Enterprise resource planning (ERP) has evolved significantly over the past few decades, with organisations demanding greater automation, real-time insights, and integration across business functions.

SAP S/4HANA, SAP’s latest-generation ERP suite, delivers a modern, cloud-ready platform that enhances data management, improves user experience, and enables organisations to make faster, data-driven decisions.

However, many organisations are discovering that despite its benefits, gaps remain, particularly in the procure-to-pay (P2P) process.

In our recent webinar, we explored these gaps and what they mean for organisations migrating to SAP S/4HANA. We also conducted live polls to understand where businesses are in their transition and how they’re managing financial controls.

Here’s what we uncovered.

Where organisations stand with S/4HANA

For many, the move to SAP S/4HANA isn’t a question of if but when. With SAP’s 2027 support deadline for ECC6 fast approaching, organisations face mounting pressure to make the switch.

In our live poll, we asked participants about their S/4HANA migration status:

- 18% have fully transitioned and are using it

- 14% are in the process of migrating

- 18% are in the planning stages

- 32% need to migrate but haven’t started yet

- 18% don’t use SAP or don’t plan to

For those that have made the transition, the experience has been mixed. As Mark Bookatz, Executive Director of Growth, noted:

“Most customers going down this path are replicating what they had in ECC6 in terms of how it’s been configured. Not many are adopting the new capability out of the box. They’re migrating what they have, which makes sense in many ways, but it does mean that they’re also carrying a lot of legacy problems that they previously had into the new world.”

This lift-and-shift approach is a missed opportunity, leaving many organisations with the same challenges they had before the migration.

The challenges of post-migration financial control

The promise of SAP S/4HANA is compelling: improved automation, real-time reporting and better financial oversight. But in practice, many organisations find that critical P2P controls still require oversight.

Here are some of the biggest challenges we’ve seen in post-migration environments:

- Gaps in accounts payable (AP) oversight

Duplicate invoices remain a common issue, often due to minor discrepancies such as extra spaces in invoice numbers or incorrect vendor assignments. Without robust controls, these errors slip through, leading to overpayments and financial leakage.

For example, one organisation processed an invoice where a minor formatting issue (a space in the invoice number) led to a duplicate being entered and approved. Since SAP’s standard duplicate invoice detection primarily relies on matching a few key fields, such subtle discrepancies were not flagged.

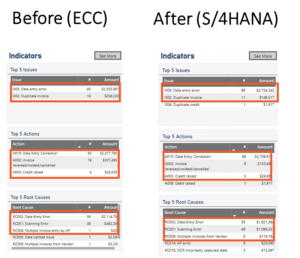

- Legacy inefficiencies persist

Rather than fully optimising processes, many businesses migrate their existing ECC6 configurations as-is. This means longstanding inefficiencies (like poor vendor data management, weak approval controls and reliance on manual workarounds) are carried forward into S/4HANA.

One organisation expected their S/4HANA implementation to improve financial controls, but an analysis of their exception volume before and after migration showed no significant change.

- Vendor master data inconsistencies

S/4HANA consolidates vendors and customers into a single Business Partner entity, but poor data migration practices can create duplicate records. This results in incorrect invoice allocations, approval delays, and compliance risks.

For example, in one case we observed, a company migrated vendor data using multiple extraction methods. Because of inconsistencies in how the data was handled, the same vendor ended up with two separate IDs in the Business Partner entity. This duplication went unnoticed until invoices were processed against both records, resulting in duplicate payments.

- Approval workflows require reinforcement

While SAP S/4HANA offers enhanced approval functionality, enforcement depends on how well organisations configure and monitor workflows. If processes are poorly defined, users may still find ways to bypass delegation of authority rules, leading to unapproved spending and audit challenges.

As Mark highlighted, “Despite the best intentions, post-implementation, organisations are very change fatigued and their budget has probably been hit quite hard. So to look beyond SAP for other solutions to help provide better financial control, despite the best of intentions, is not always happening.”

How organisations are managing financial controls

To understand how businesses are strengthening financial oversight, we asked webinar attendees about their approach to controls in SAP S/4HANA.

- 50% use or plan to use additional systems outside of SAP

- 20% rely solely on S/4HANA

- 20% haven’t considered additional measures yet

- 10% don’t use SAP, so this wasn’t applicable

These insights reinforce the importance of continuous financial oversight, whether through SAP’s compliance solutions or third-party tools.

Organisations that take a proactive approach to monitoring and compliance are better positioned to catch errors, reduce fraud risk and maintain governance standards.

Optimising financial controls in SAP S/4HANA

To fully leverage SAP S/4HANA’s potential, organisations must take a proactive approach to financial control. Here are a few key actions for a successful migration:

- Plan beyond “lift and shift.” Migrating legacy inefficiencies to a new system only perpetuates the same problems. Take the opportunity to rethink processes and strengthen controls during the transition.

- Implement continuous monitoring. SAP S/4HANA’s standard controls don’t always catch errors and fraud. Implementing a continuous monitoring solution can help flag duplicate payments, unauthorised transactions and data inconsistencies in real time.

- Improve vendor data governance. Ensure vendor master data is clean and consolidated before migration. Addressing duplicate records, outdated details and incorrect mappings upfront can prevent issues post-go-live.

- Reinforce approval workflows. Evaluate whether approval rules are effective and consider additional controls to prevent unauthorised workarounds. Automation can enforce compliance and reduce manual intervention.

Strengthening financial control beyond S/4HANA

SAP S/4HANA delivers significant business benefits, but financial oversight requires a holistic approach. Organisations that take the time to optimise processes, implement strong controls, and ensure seamless data integration will be best positioned to succeed.

If your organisation is navigating an SAP S/4HANA migration or facing post-implementation challenges, we can help. Speak to the Satori team to explore how continuous monitoring can strengthen your financial controls, prevent errors, and enhance compliance.