According to Gartner, 85% of organisations are currently undertaking a financial transformation project. The other 15% are likely to begin one soon or have recently completed one.

There’s a good reason these projects are so popular. Financial transformation is necessary for organisations to continue to operate, perform, and remain competitive as markets and technology continue to evolve.

But while statistics show that transformation projects are being undertaken in huge numbers, they also show that many of them are unsuccessful.

In a recent webinar, Satori brought together finance, technology, and customer success experts Mark Bookatz, Troy Nicholson, and Natalya Levenkova to discuss why successful financial transformation can be so challenging.

Here, we recap the discussion about the ins and outs of transformation projects, the most common pitfalls, and how to make small changes in the process to achieve better outcomes.

The reality of financial transformation

Financial transformations are critical for efficiency and performance improvement across critical finance functions. Transformation projects are usually large investments that take time to complete and will often include:

- Automation

- Tech integration

- Data management

- Compliance & risk management

- Change management

- Reporting

Whether the project is initiated by the CIO, the board, or an external consultant, the vision is usually that of amazing efficiency, cost savings, and improved outcomes for employees and customers alike.

Unfortunately, it’s common for the final reality to end up far removed from the original vision.

Gartner studies show that 69% of financial transformation projects progress slower than projected, while almost a third fail to deliver expected benefits. In a 2023 KPMG survey, 51% of respondents admitted they had not seen an increase in performance or profitability from transformation investments.

These are troubling statistics for anyone undertaking a transformation project.

What is also interesting is a 2024 Blackline survey that found 22% of Australian CFOs don’t fully trust the accuracy of their organisation’s financial data. A webinar participant echoed this sentiment, speaking about the newfound difficulty of accessing the right financial data after their organisation had gone through a transformation.

Data is an extremely important part of business operations, yet often, transformation projects can drastically affect data accuracy, and access, which can be overlooked in the planning stages. (More on this later).

Statistics are one thing, but what are the impacts of them? How does this reflect on real businesses investing in financial transformations?

What we’ve seen go wrong

With any major project, there are always multiple risks and chances for things to go wrong. In our experience, the riskiest transformations are those that are looking to implement a new payroll/HR system or a new ERP—both major undertakings.

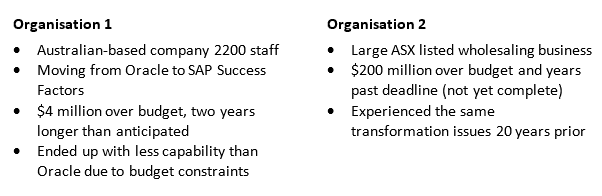

Satori has worked with several major organisations that have undertaken financial transformation projects alongside or prior to using our services.

Satori Co-Found Troy Nicholson spoke during the session about some of the projects he has witnessed and the extreme consequences that come with failing to consider all risks.

It is easy to imagine that large, successful companies would have the budget and expertise to ensure a well-planned, successful transformation project. But even some of the most well-resourced and well-respected businesses can fall victim to transformation pitfalls.

Why does it happen? The most common financial transformation pitfalls

Time and again, we see the same common (and avoidable) mistakes that lead to unfortunate results like those mentioned above. These include:

No ongoing improvement

Organisations will put all their focus and energy into the big goal of going live. Too often, there is a false sense that once the transformation is complete, the job is done. The idea of a continuous cycle of improvement (both during the project and after going live) is lost.

Falling into the automation trap

While automation is a critical component of financial transformation that should be tapped into, it’s not a magic pill. While automation may reduce or eliminate the risk of manual errors, it can be responsible for different errors. There may be different causes, but you can end up with the same outcomes.

A lack of oversight

Of how the project and transformation will impact employees, operations and business in general both during and after completion and how any risks or interruptions can be managed or mitigated.

Integration dangers

System integrations are often massively complex projects that need to be maintained continuously. It is not uncommon for two systems with two different vendors to be integrated, which means any small changes to one system can impact the integration.

External risk focus

It can be easy to become much too inward-focused, looking only at internal technology and operations. This can lead to ignoring or being underprepared for growing external risks (like cyber attacks) which can impact not just the project but the overall business.

While any transformation project should overall deliver better usability, outcomes, and performance, new systems and processes will always leave changes and gaps. That is why the planning process should include contingency planning and options to lower risks. Failure to recognise, understand, and mitigate these gaps often prevents projects from delivering on their full potential—even once they’re complete.

How to avoid disaster for a successful financial transformation

Plan for the process, not just the end result

We often see organisations go through ‘transformation stagnation’, simply waiting for everything to come together at the go live. Financial transformations are often big projects that can take months or years to complete. There needs to be hold over processes put in place so that operations can continue and employees still not what they’re doing (and how) while the transformation takes place.

Think about the people, not just the outcome

Usually, transformation projects are planned and approved by people who will not be overly impacted by the process or the end outcome. This can lead to employees finding that new systems don’t work for them or give them the capability they need to do their jobs. That’s why it’s so important to review current operations and processes and bring the whole team into the conversation early to ensure no core capabilities are lost in the transformation.

Keep data access capability front of mind

As we mentioned earlier, discovering you don’t have access to the right data is a common outcome of financial transformations. How the organisation will actually get data out of their new system is often an afterthought. Transformation planning needs to include data accessibility ‘how’ and ‘when’, as well as a Plan B if things don’t go to plan. Remember, new processes and systems will introduce new issues. It pays to be prepared for them.

Think before you surrender

Only surrender your old systems once you know for sure that your new system is implemented and can deliver the same capability as your old one. You need to understand how the new product or process works (and that it solves your problem as well as your existing solution) before you start to rely on it. More often the not, you’ll find gaps when replacing one solution with another. You may need to keep some of your old solutions on, even after a successful transformation.

Measure your expectations

While you should expect a financial transformation project to uplift organisations performance and capability, it’s unreasonable to expect it to go off without a hitch. Technology, automation and integration don’t automatically eliminate gaps or errors. In fact, they can often add more. New systems take time to get right – even a successful transformation project is unlikely to work perfectly from go live.

Ultimately, it’s the planning and collaboration that goes into a financial transformation that will impact how successful the outcome is. It is far better to take time on the front end to get the strategy right than to add years to the end of the project due to unforeseen pitfalls.

Why are you doing it, what are the gaps you are trying to solve, and what is the best way to do it?

If you’re looking to better manage and monitor financial controls and security before, during or after financial transformation projects, we invite you to explore Satori’s services and solutions that can support all business functions.