As automation continues to transform back-office operations, many large organisations are shifting their focus to accounts payable (AP) automation. While the promises of efficiency, accuracy, and fraud reduction are compelling, the reality is that automation isn’t the panacea it’s often believed to be. Even with high-performing optical character recognition (OCR) tools and streamlined workflows, gaps remain, and those gaps, if left unmonitored, can result in serious financial and compliance risks.

At a recent Satori hosted webinar, our experts and customer success leaders, Troy Nicholson, Mark Bookatz and Natalya Levenkova shared practical lessons from working with enterprises across mining, government, and commercial sectors. The takeaway was clear: monitoring must be treated as a critical pillar of the AP automation journey, not just an afterthought.

AP automation: The state of play

From public agencies to ASX-listed corporates, most companies share a common goal: to reduce manual effort, improve accuracy, and create scalable, efficient finance environments.

Typically, organisations begin with automation in five key areas:

- Invoice data entry (OCR/Scanning) – Replacing manual data entry with OCR to reduce labour costs and eliminate typing errors.

- Invoice workflow approvals – Automating approval flows to move away from spreadsheets or email chains, ensuring audit trails and escalations are in place.

- Three-way matching – Automatically matching invoices to purchase orders and goods receipts before releasing payments.

- Payment automation – Streamlining payment runs and reducing reliance on manual uploads or internet banking authorisations.

- ERP integration – Ensuring that automation tools work seamlessly with enterprise systems like SAP, Oracle, or TechnologyOne.

Despite these advances, only a small subset of organisations have reached full end-to-end automation without human intervention. Adoption of AI remains modest, with most businesses using it experimentally or in limited areas like exception handling or fraud detection.

Where companies stand

During the webinar, a live poll asked participants about their stage in the AP automation journey. The results were revealing:

- 38% reported having already implemented automation to a significant extent.

- 33% were currently in the process of rolling out automation.

- 10% were in early planning stages.

- 19% expressed interest but had not yet commenced the process.

- 0% indicated no plans to automate.

These numbers show that AP automation is no longer a future initiative, it’s an active agenda item. However, a second poll further emphasised that 86% of respondents were either using or planning to use additional monitoring controls, acknowledging the limitations of automation alone.

The hidden challenges of AP automation

Automation streamlines processes, but it also creates new risks. These real-world examples show where things can go wrong – and how active monitoring keeps AP operations on track.

Optimising financial controls in SAP S/4HANA

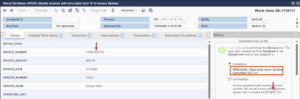

One of the most commonly implemented automation tools is OCR, the scanning and data extraction tool used to digitise invoices. However, poor-quality scans, faded text, or unusual invoice formats can confuse OCR software. A recurring issue is the misinterpretation of similar-looking characters, such as confusing the number “0” with the letter “O”.

In one example, a vendor’s invoice reference “Oct-1234” was misread by OCR as “0ct-1234,” creating a duplicate entry in the system and risking double payment.

Satori’s monitoring flagged the anomaly through data validation checks, preventing a duplicate and ensuring payment accuracy. OCR errors happen. Active monitoring is essential to catch issues before they trigger financial mistakes.

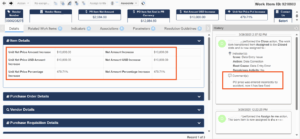

The pitfalls of strict three-way matching

Three-way matching is a widely respected control for ensuring accurate payments. It works by comparing the invoice to both the purchase order and the goods receipt. However, overly rigid matching rules can create bottlenecks.

In one example from a government department, its automated three-way match rejected an invoice over a minor $10 freight charge variance. The delay wasn’t flagged, leaving the supplier unpaid.

The organisation fine-tuned their three-way match configuration by introducing tolerance thresholds for minor discrepancies. They also implemented monitoring reports that tracked invoice exceptions and flagged any that remained unresolved for more than a few days.

The result? Fewer false positives, quicker resolutions, and greater confidence among both AP staff and suppliers.

Automation needs flexibility. Monitoring ensures exceptions are surfaced and resolved quickly.

Master data issues and fraud risk

Even best-in-class automation cannot prevent errors if vendor master data is flawed. And in many systems, changes to master data are not subject to rigorous scrutiny. This creates a significant fraud risk, particularly in cases involving business email compromise (BEC).

One large organisation discovered that a fraudster impersonated a supplier and requested bank detail changes. The update went through without dual approval, nearly resulting in a fraudulent payment.

This wasn’t just an individual oversight, it was a systemic gap in governance.

The organisation introduced dual verification, segregation of duties, and monitoring for critical master data changes. Satori’s solution also prompted users to record the root cause and resolution of any flagged anomaly, supporting trend analysis and process improvement.

Automation accelerates both good and bad processes. Strong governance and continuous monitoring protect against fraud.

Monitoring as a strategic imperative

Many organisations start their automation journey believing that once processes are digitised, the risk of error disappears. But as these case studies illustrate, automation introduces new risks, and monitoring is essential to catching them early.

Continuous monitoring provides a feedback loop that automation alone lacks. It allows finance teams to identify common failure points, understand the root causes of recurring issues, and tweak rules or workflows accordingly.

Moreover, monitoring dashboards surface real-time metrics, such as exceptions per thousand invoices, average approval times, and unresolved master data conflicts. This transforms monitoring from a reactive activity into a strategic enabler of continuous improvement.

Satori’s approach: ready-to-deploy monitoring

At Satori, monitoring isn’t an afterthought, it’s built into our AP assurance platform. Clients begin with foundational controls (like duplicate invoice detection or approval SLA tracking), then expand into advanced use cases:

- Invoice data field validation

- PO and receipt matching exceptions

- Vendor master file audits

- Fraud pattern analysis

These controls are pre-configured based on industry best practices, yet highly customisable to each client’s specific risks and processes. And because the platform requires every exception to be resolved with a root cause and action taken, it doubles as both a compliance tool and a process optimisation engine.

Modern AP needs more than automation

Automation can unlock huge gains in efficiency, visibility, and control, but only if paired with the right governance and monitoring. As organisations scale and their AP operations become more complex, the cost of ignoring small issues rises exponentially.

The ultimate goal may be a “zero-touch” AP environment, but that doesn’t mean zero oversight. From OCR to payments, every automated process needs guardrails. Monitoring ensures that your systems perform as expected, and that exceptions are identified and addressed before they escalate.

If you’re on your AP transformation journey, or about to begin, make sure monitoring is part of your roadmap from day one. Automation is powerful, but vigilance is priceless.